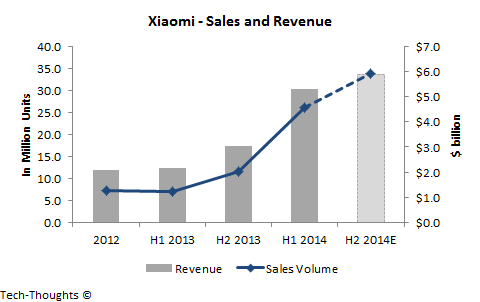

Yesterday, Xiaomi announced that it sold 26.1 million smartphones in H1 2014, totaling $5.3 billion in revenue. Xiaomi's goal is to sell 60 million smartphones and generate $11.2 billion in revenue by the end of the year, but these figures seem too conservative when compared to their current performance.

As these figures came out, Xiaomi's staggering 271% YoY growth seemed to dominate headlines. But annual growth figures are quite meaningless at this stage of their growth. As I wrote in Xiaomi & Cyclicality, their sequential growth trajectory is far more interesting:

Lack of cyclicality is usually driven by a couple of factors -- (1) A rapidly growing market, (2) Product and business model superiority relative to the basis of competition prevalent in the market, and (3) Expanding geographical reach. It seems that rapid sequential sales growth with minimal cyclicality seems to be a good indicator of future performance.

Xiaomi needs to sell ~34 million smartphones in H2 2014 to hit that 60 million mark, but that would imply a significant slowdown in growth.

Looking at the chart above, Xiaomi would need to sell ~65 million smartphones in 2014, or ~39 million in H2 2014, to maintain their current growth trajectory. This should result in roughly ~$12 billion in annual revenue after taking into account expected ASP declines in line with Xiaomi's business model. This will be a crucial test to gauge Xiaomi's ability to scale and cater to multiple geographical segments.