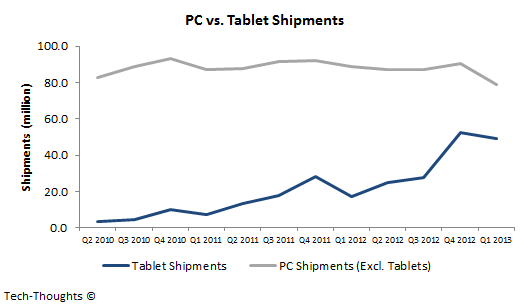

A few months ago, I had estimated that tablet shipments would overtake PCs by Q1 2014. This was based on the fact that the substitution

rate pattern of tablets vs. PCs was similar to the one we saw in the early days

of the modern vs. legacy smartphone battle. Let’s use the tablet & PC shipment data from Q1 2013 to revise our estimate.

The tablet vs. PC substitution rate in Q1 turned out to be much

higher than my estimate. This was partially driven by quicker adoption of tablets in emerging markets, and a major decline in PC shipments (thanks to tablet adoption and consumer response to Windows 8). While tablet vs. PC substitution rate is currently considerably

higher than that seen for modern vs. legacy smartphones, the two patterns show

a correlation of nearly 95%.

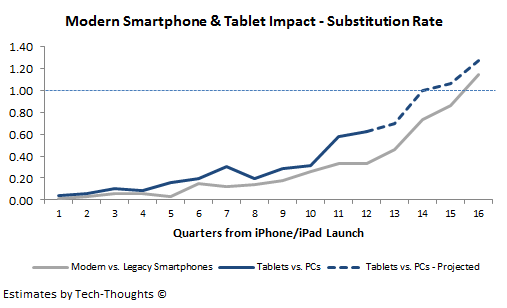

In order to be conservative, my original estimate

assumed that the deviation between the two substitution rate patterns would

decline over time, i.e. the growth in tablet vs. PC substitution rate would

slow over time. However, at least for now, it seems as though that assumption

may not necessarily be correct. Therefore, it may be more prudent to consider

two cases: One where the deviation between the two trends narrows and one where

it doesn't.

Case-1: Declining Substitution Rate Deviation

The substitution rate pattern in the chart above assumes that the deviation between the two patterns narrows over the next year. Based on this pattern, and my previous assumption for the growth of the overall tablet + PC market (cyclical with low average growth), we get the following shipment projection for tablets and PCs:

As the chart above shows, Q4 2013 would be the first full quarter in which quarterly shipments of tablets would exceed those of PCs, as PC shipments drop to ~70-75 million and tablet shipments near 80 million.

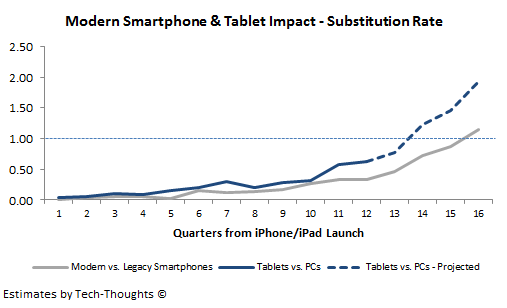

Case-2: Consistent Growth in Substitution Rate Deviation

Here, the substitution rate maintains its current trajectory over the next year. In this case, using the same assumption for overall shipment tablet + PC shipment growth, we get the following estimate for tablet & PC shipments:

In this case, the crossover between tablet and PC shipments occurs earlier, i.e. in Q3 2013, as PC shipments drop to roughly ~65 million and tablet shipments cross 75 million.

While there isn't much variation in the point of crossover, the PC shipments drop much faster in the second case. These shipment estimates could be affected by the pace of of low cost tablet penetration in emerging markets and any changes to the Windows 8 operating system. However, given the scale of the figures, I can say with confidence that quarterly tablet shipments should overtake those of PCs by late 2013.