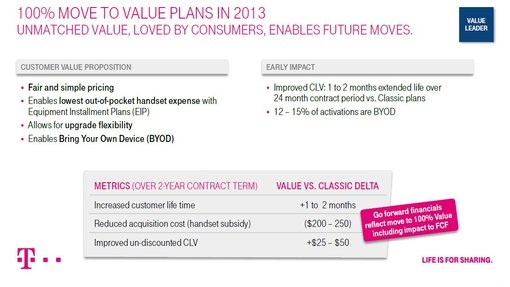

T-Mobile has been very outspoken about the negative impact of the subsidized smartphone distribution model on the wireless industry and this is the first major move by an industry giant against the practice. While value plans are said to have lower margins as compared to subsidized plans, the impact on T-Mobile should be positive, as it allows them to directly reduce the average acquisition cost of a smartphone subscriber (the primary cost associated with churn rate) by about $200-$250. In addition to this, value plans seem to have higher customer life (i.e. lower churn rate), while maintaining cost parity (via the monthly device payment model), with subsidized plans. Of course, this would vary based on the cost of the device itself.

Impact on Carriers

In the near term, I don't expect this move to be mimicked by AT&T, Verizon or Sprint, as those carriers are already tied into long-term contracts with Apple. However, once their contracts expire, those decisions should be driven by consumer response to T-Mobile's value plans. T-Mobile has stated that about 80% of their current postpaid activations were on value plans, which suggests that it does hold appeal to consumers. However, T-Mobile was inherently at a disadvantage without the iPhone, which insulated the impact of these value plans on churn rates. Going forward, if T-Mobile's value plans have any meaningful impact on churn rates of their competitors, I would expect other carriers to mimic this strategy to complement their current offerings, even if they cannot eliminate subsidies.Impact on OEMs

The initial impact on OEMs should be minimal, but there could be a long-term impact if other carriers begin to offer a similar model to their consumers. The impact could be very similar to the "ripple effect" goal of Google's wireless strategy, except that the monthly financing model may not have a major impact on smartphone margins. Disassociating data usage expenses with device costs could generate awareness among consumers of the value of the hardware itself, which in turn could extend the handset replacement cycle and slow down the pace of smartphone sales in the US. Recon Analytics' research showed that for every $100 reduction in smartphone subsidy, the smartphone replacement cycle is extended by 8.6 months (assuming that the unsubsidized cost was paid upfront). But even with a financing plan, since consumers are fully aware of the cost of the device, we could see a similar, but moderately diluted impact on the smartphone replacement cycle.The short-term impact on Apple would undoubtedly positive as it adds to the iPhone's distribution, while the long-term impact is more difficult to gauge Apple's prospects should be initially insulated by their contracts with carriers. But if there is any impact on churn rate and profitability in the medium-term, I would expect to see distribution models like this crop up during the next round of contract renewal negotiations, which could lead to a drop in the iPhone's ASP or market share (depending on Apple's decision on product mix), as consumers shift to cheaper models.